- Benefits brokers work for insurance companies — not you, and this is problematic because most employers expect brokers to negotiate pricing with insurers on their behalf. Since benefits brokers get paid commissions and bonuses from insurers, brokers have little incentive to lower your insurance costs. Imagine working with a CPA who gets paid by the IRS instead of you…you’re guaranteed to pay more in taxes than you should, and it’s no wonder that 25% of what employers spend on healthcare is complete waste.

- Benefits brokers usually don’t contractually disclose how they get paid even though Federal law requires it under the Consolidated Appropriations Act, which took effect January 1st, 2022. This can leave employers facing financial penalties for non-compliance.

- Since most brokers sell a limited number of commoditized insurance products, they attempt to differentiate themselves by providing “value-added services” such as free benefits administration technology. The problem is that these siloed platforms often make benefits administration harder — not easier.

- Benefits brokers market themselves as objective or unbiased, but when 20% to 30% of their revenue comes from bonuses from one or two insurance carriers, how unbiased can they be?

- To retain your business, some benefits brokers will run down the clock by withholding your insurance renewal until the last minute, so it’s nearly impossible for you to change benefits firms during your renewal period.

- Benefits brokers sell employers point solutions such as telemedicine without disclosing how much they’re marking up the price of the service.

- Benefits brokers will sell you insurance products without properly vetting or reading the contract they’re selling you. This can leave employers and employees with the short end of the stick when claims get denied.

- Benefits brokers will water down coverage in an attempt to make the premium increases more plausible.

- Benefits brokers rarely have the highest certifications or designations in the industry. As a result, they are more likely to create risks than manage them.

- Benefits brokers say they “have access to the entire marketplace of insurance products,” but you’ll only see the four large insurance carriers because that’s who pays them the most.

- Benefits brokers don’t teach employers about various ways to finance and procure healthcare. They show up with the same spreadsheet every 12 months and show you the lowest rate on the spreadsheet.

- Benefits brokers use benchmark reports to lower your expectations.

- Benefits brokers don’t look for new ways to mitigate risk all year round.

- Benefits brokers don’t understand your perceptions of risk or your tolerance to change.

- Benefits brokers don’t understand your business objectives and, therefore, don’t develop strategies to achieve them.

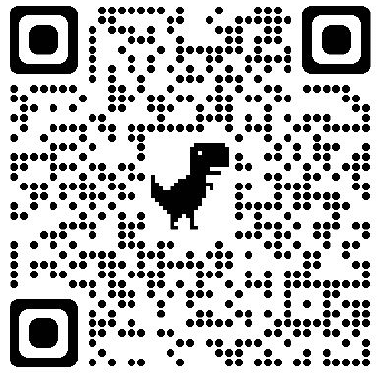

If you want to discover everything you need to know about selecting the right benefits firm for your organization, download our Ultimate Buyer’s Guide.