Benefits Brokers Have No Incentive To Reduce Your Healthcare Costs

That's why we created Health Compass.

A new kind of professional services company that helps employers maximize the return on their benefits investments through financial alignment and certified expertise.

✓ Attract & Retain Talent

✓ Maximize Business Value

✓ Increase Cash Flow

Our mission is to eliminate the $300 Billion that employers waste on healthcare every year.

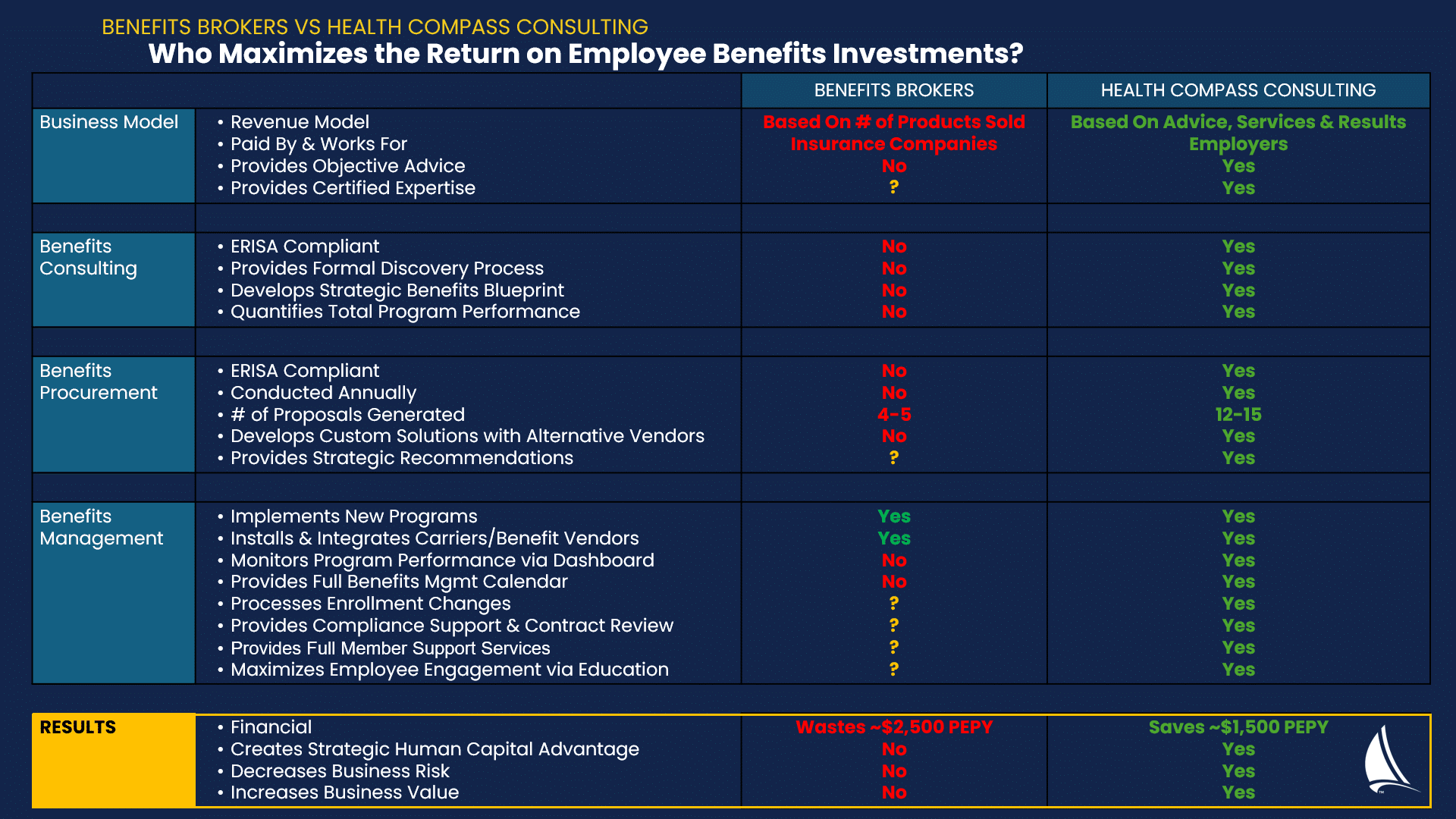

That equals about $2,500 per employee, per year in waste (yikes).

For businesses that are serious about taking care of their employees by maximizing the return on their benefits investment, Health Compass is the fee-based, carrier-agnostic benefits consulting firm that helps businesses achieve their goals through alignment, process, and certified expertise.

“Health insurance is the most frustrating part of running my business” - Executives, Everywhere.

Although 81% of employers expect their benefits broker to help them maximize the return on their benefits investment, healthcare has become a top expense for most organizations, and 25% of what the average employer spends is considered waste.

The problem is that benefits brokers work for insurance companies — not you — which is why it never feels like anyone is looking out for your best interests.

Imagine having clarity, control, and a true advocate.

Imagine not having to make difficult decisions at renewal time. Imagine not having to disappoint your employees at open enrollment. Imagine having a strategic advantage in the market that increases your business’s value and ability to attract and retain talent.

Replace your benefits broker with a fee-based, carrier-agnostic benefits consulting firm

Start getting clarity and better financial results by replacing your carrier “lap-dog” with a fee-based watchdog from Health Compass. Why?

Here’s how it works:

Step 1) Assess Your Program - Spend ~8 minutes completing Health Compass’s Total Benefits Assessment and get your score immediately.

Step 2) Review, Express, Discover - Meet with Health Compass to review your score, express your company’s unique requirements, and learn more about the employee benefits landscape.

Step 3) RFP - Request a proposal to see if we’re a good fit for your organization.

Ken Peach

// Executive Director

Health Council of East Central Florida

“Health Compass has its own path to save employers over $1,000 per employee while also eliminating copays and deductibles that often prevent employees from getting the care they need. We like innovation as it creatively brings down health care costs and benefits everyone."

Ready To Get Started?

We only work with professionals who are serious about taking care of their employees by maximizing the return on their benefits investment.

“Insanity is doing the same thing over and over again and expecting different results”

- Albert Einstein

Satisfaction Guaranteed.

Get the clarity and confidence needed to gain control and maximize the return on your benefits investment.

Don’t Take Our Word For It..

What Our Clients Say

Health Compass not only showed us how to reduce costs without compromising coverage, but they also connected us with employers who were looking to work directly with independent healthcare providers like us.

Dr. Edie K. Benner PT, PhD, OCS, President at Advanced Rehabilitation & Health Specialists

“Without Health Compass, our healthcare costs would have increased by more than $1,800 per employee this year. For staffing companies, employee benefits are a complex subject, and Health Compass did a great job understanding our business and finding innovative ways to protect our people and our bottom line.”

Charlie Lewis - CEO, Bluewave Resource Partners

“Very knowledgeable and insightful --- I recommend working with them”

- James Engstrom, Eagle Trace Consulting!

Health Compass was able to guide us and bring about a change with a new Pharmacy Benefits Manager (PBM) that will save the District $3.6 million dollars. This money will now be available to fund raises for our teachers, bus drivers, and all education support professionals. We look forward to continuing the journey.

Judy Ngying - Past Vice President

Seminole Education Association

“Health Compass shopped all the usual carriers, but their custom solution saved us over $1,400 dollars per employee and eliminated copays and deductibles for our team…a solid win all around”

Ben Collins - President, Boldist

“I still hate health insurance, but at least Health Compass saved us over $3,000 dollars per employee and improved coverage the year before our exit"

Chris Pyle - CEO, Champion Solutions Group

Health Compass not only showed us how to reduce costs without compromising coverage, but they also connected us with employers who were looking to work directly with independent healthcare providers like us.

Dr. Edie K. Benner PT, PhD, OCS, President at Advanced Rehabilitation & Health Specialists

“Without Health Compass, our healthcare costs would have increased by more than $1,800 per employee this year. For staffing companies, employee benefits are a complex subject, and Health Compass did a great job understanding our business and finding innovative ways to protect our people and our bottom line.”

Charlie Lewis - CEO, Bluewave Resource Partners

“Very knowledgeable and insightful --- I recommend working with them”

- James Engstrom, Eagle Trace Consulting!

Health Compass was able to guide us and bring about a change with a new Pharmacy Benefits Manager (PBM) that will save the District $3.6 million dollars. This money will now be available to fund raises for our teachers, bus drivers, and all education support professionals. We look forward to continuing the journey.

Judy Ngying - Past Vice President

Seminole Education Association

“Health Compass shopped all the usual carriers, but their custom solution saved us over $1,400 dollars per employee and eliminated copays and deductibles for our team…a solid win all around”

Ben Collins - President, Boldist

“I still hate health insurance, but at least Health Compass saved us over $3,000 dollars per employee and improved coverage the year before our exit"

Chris Pyle - CEO, Champion Solutions Group

Still Have Questions?

No. When fee-based consulting firms get quotes from traditional Carriers, they instruct Carriers to remove commissions from the product. Instead of the 4%-6% commission paid by Carriers to brokers, fee-based firms often charge a flat fee that ranges from $25 - $60 per employee per month, depending on which services the firm includes in their service package.

While fee-based firms may generate slightly more or less revenue than traditional brokerage firms, it’s important to remember that the value created from getting objective investment advice far exceeds any slight compensation deviations between brokers and fee-based consultants.

- For example, if an employer with 100 employees spends $1 million yearly on their health plan, a broker would normally receive 5% ($50,000/year) in commission.

Even if the fee-based firm charged the employer $75,000 ($25K more than the broker was getting in commissions), but their recommendations saved the employer $100,000 on their plan, the employer still netted $75,000 in savings for a product of equal or better value.

Although a fee-based firm’s compensation may be higher or lower in certain circumstances, the critical thing to remember is that, unlike benefits brokers, fee-based firms are not penalized for giving employers their best advice on how the employer should invest healthcare dollars.

Brokers and fee-based firms have access to the entire marketplace of insurance products. Unlike brokerage firms, fee-based firms are not financially penalized for maximizing the return on an employer’s benefits investment. They are laser-focused on helping their clients achieve their business objectives.

Broadly speaking, fee-based firms save employers money by 1) showing employers how to stop paying for healthcare employees never actually consume and 2) showing employers how to stop overpaying for the healthcare their employees do consume.

Absolutely not. Since some Carriers pay brokers more than others, it is challenging for brokers to give employers objective investment advice about which products to buy. Furthermore, employers who work with benefits professionals whose financial interests are misaligned with theirs are more likely to purchase products from vendors whose economic interests are also misaligned with theirs. Seeing how vital aligning financial interests is to maximize a company’s health investment, fee-based consultants are more likely to outperform a brokerage firm’s commissioned salespeople.

Understanding the intricacies of healthcare financing and procurement methods, healthcare supply chain management, and the ever-changing regulatory environment should not be left to brokers who merely possess an insurance license.

Verify that the specific broker or consultant you will be working with has the highest designations and certifications in the benefits industry, as this is akin to having a Ph.D. in other sectors.

They are as follows:

- Certified Health Value Professional (CHVP) - awarded by the Validation Institute.

- Registered Employee Benefits Professional (REBC) - awarded by the National Association of Benefits and Insurance Professionals.

- Certified Employee Benefits Specialist (CEBS) - awarded by the International Foundation of Employee Benefit Plans

Who Are You, Anyway?

While working on the carrier and brokerage side of the employee benefits industry, Donovan Pyle identified a fundamental misalignment in the market: Brokers make more money when their client's costs go up, and this undermines the employers' ability to get unbiased advice on how benefits dollars should be invested.

The problem inspired Donovan to develop and found one of the first fee-based, carrier agnostic employee benefits firms in 2018. By working directly for employers instead of vendors, Health Compass Consulting — escapes the financial conflicts of interest that prevent employers from getting the results they desire.

Today, Health Compass's clients have anywhere from 10 to 10,000 employees and save approximately $1,500 per employee per year -- without watering down coverage.

Pyle holds the highest consulting designation awarded by the NAHU, is the Vice Chair of the Health Council of East Central Florida, and is one of twenty-eight consultants in the U.S. certified by the Validation Institute.

His writing can be seen in Yahoo Finance, SHRM, Seeking Alpha, and many other national publications, and he can be reached at donovan@healthcompassconsulting.com

The Ultimate Employee Benefits Buyer’s Guide From Health Compass Consulting

The Fee-Based, Carrier-Agnostic

Employee Benefits Consulting Firm

You need confidence, clarity and control to make effective decisions.

Employers who replace their benefits broker with Health Compass's fee-based, carrier-agnostic benefits consulting services gain a strategic advantage in the marketplace and, thus, increase their ability to achieve key business objectives.

With Health Compass, we were able to revamp our health insurance strategy — IMPROVE the availability of our best plans to remote employees, improve benefits communication throughout the organization, and save on premium costs.

– Julie Garofalo, HR Manager at Champion Solutions Group

“Health Compass showed us how to drastically reduce our costs while improving benefits for our employees.”

– Molly Sedensky, CFO

How to Get Started

01

Assess Your Program

02

Gain Clarity

03

Discover Our Services

Benefits Are Meant to Attract & Retain Talent.

The Problem

Although 81% of employers use benefits brokers to help them maximize the return on their benefits investment, healthcare has become a top expense for most organizations, and 25% of what the average employer spends is considered waste.

A root cause of this waste is that benefits brokers get paid commissions and bonuses from health insurers and vendors, meaning brokers make more money when an employer’s healthcare costs go up – not down. Therefore, benefits brokers have little incentive to maximize an employer’s healthcare investment.

The Solution

As an antidote to the failed brokerage industry, Health Compass’s fee-based, carrier-agnostic benefits consulting services allow us to maximize our client’s benefits investments — without financial conflicts of interest.

The Results

Being that Health Compass consultants hold the highest certifications in the employee benefits industry and operate without financial conflicts of interest, we naturally produce:

Higher profit margins

Increased cash flow

Better benefits for employees

For example, our average client saved ~$1,500 per employee after switching to Health Compass last year.

Conclusion

Employers who replace their benefits broker with Health Compass gain a strategic advantage in the marketplace and, thus, increase their ability to achieve key business objectives.

Next Steps

Complete the Total Benefits Assessment so we can understand the state of your current program and identify opportunities for improvement.