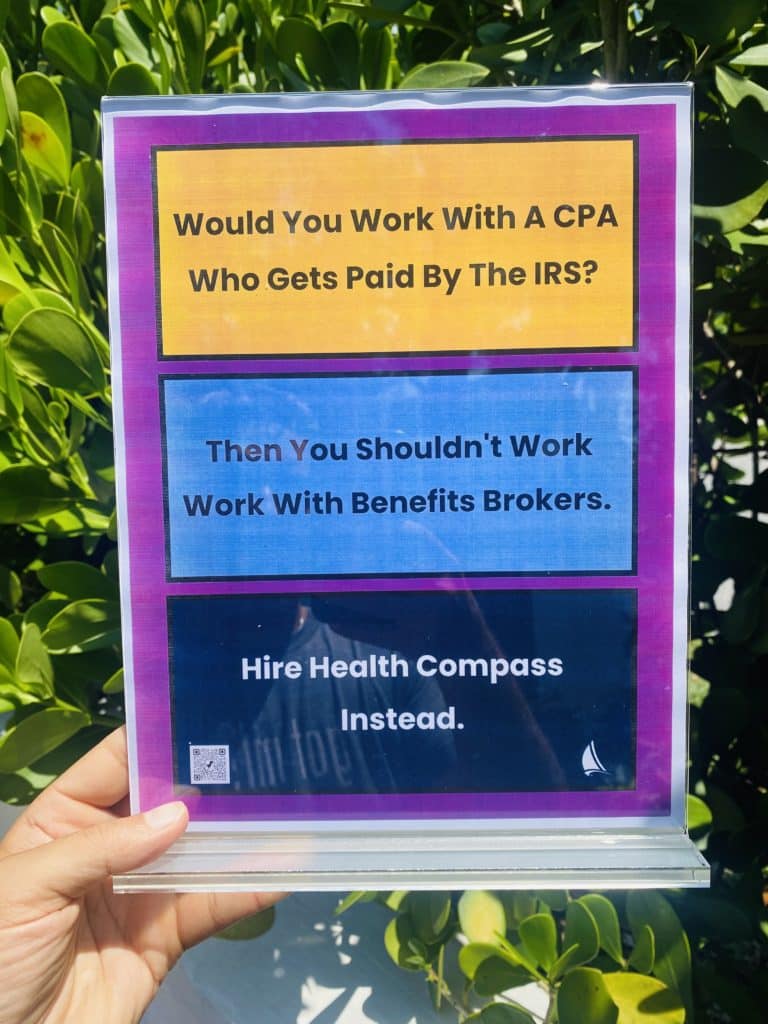

Would you work with a CPA who gets paid by the IRS — instead of you?

What if the CPA got paid by the IRS a percentage of what you paid in taxes?

How might that effect how much you pay in taxes?

Benefits brokers operate the same way as the CPA who works for the IRS.

They work for insurance companies, and they make more money when your rates go up — not down.

As a result of this conflict of interest, companies waste 25% of what they spend on healthcare.

That equals $300 BILLION or ~$2,500 per employee, per year.

To fix this, I founded the first non-commission-based benefits consulting firm in 2018.

Since we work for employers — not the insurance companies, we’re free to give our clients unbiased advice about how to maximize the return on their benefits investments.

As a result of our financial alignment with our clients, they typically save about $1,500 per employee, per year— while delivering more value to their team.

Our mission is to eliminate the $300 billion employers waste on healthcare every single year.

We’re a long way from achieving that, but we have saved our clients millions of dollars over the past few years in all kinds of industries — from technology, to construction, to healthcare, to education…you name it.

If you’re tired of rising healthcare costs and not having someone sit on YOUR side of the table, send us a message.