Introducing the Total Benefits Assessment from Health Compass Consulting

Introducing the Total Benefits Assessment (TBA) - A Framework for Continuous Improvement

From Health Compass Consulting

We are excited to release the Total Benefits Assessment, which provides the structure for our entire customer journey. As we know, what gets measured…gets improved.

My name is Donovan Pyle, and I'm the CEO and Founder of Health Compass.

Today, Michael Salcido, our chief strategy officer, is with us. Michael is a 27-year industry veteran who worked at all the major firms before joining Health Compass. Most notably led the employee benefits practice at Zenefits when it went public in 2017.

Also with this is Maurice Clark, who spent nine years managing benefits at Darden Restaurants and their 180,000 employees before joining Health Compass in 2022.

For those of you keeping score at home, Health Compass is one of the few benefits firms in the country with the highest certification and designation in the employee benefits industry.

And that really matters because the last thing you want is a medical assistant doing brain surgery on your benefits program.

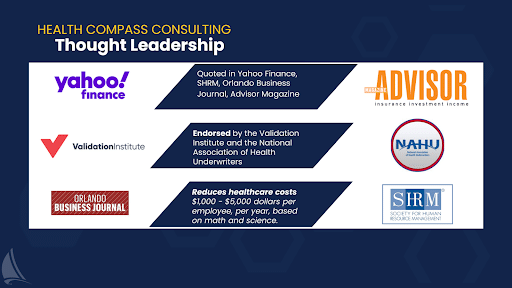

You may have seen our thought leadership in national publications such as Yahoo Finance, Seeking Alpha, SHRM, and others.

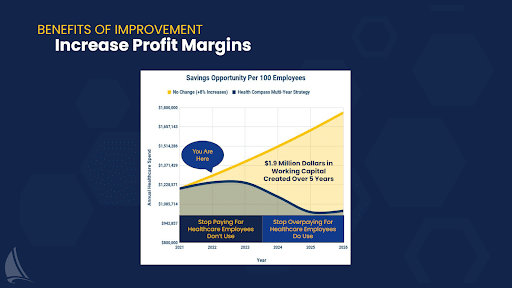

We’re making a name for ourselves because we financially align ourselves with employers to help them maximize the return on their benefits investment. This typically results in our clients saving over $1,000 per employee per year while improving benefits for their population.

And yes, we wrote the book on choosing the right fee-based benefits consulting firm for your organization.

And by the way, the Validation Institute endorsed this buyer’s guide in 2023.

So, let's talk about the origin story of how this total benefits assessment came to be.

We were doing some M&A work for a large organization, and during one of the stakeholder meetings, the CEO asked everyone, “Is our benefits program getting better or worse?”

It is a very simple question, but when you consider the value equation, it's actually kind of difficult to answer.

The reason that so many executives have difficulty answering that question is because no one has helped them quantify the value equation of their benefits program.

As we all know, benefit benefits programs are typically a top three expense, and it’s typically the fastest-growing financial risk on corporate P&Ls.

If you don't have a framework for quantifying the value equation, it's hard to know where the opportunities or how to maximize the return on your benefits investment.

After seeing this problem repeatedly, we decided to develop a framework that brings order to chaos.

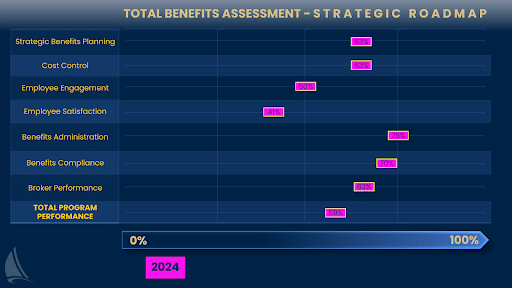

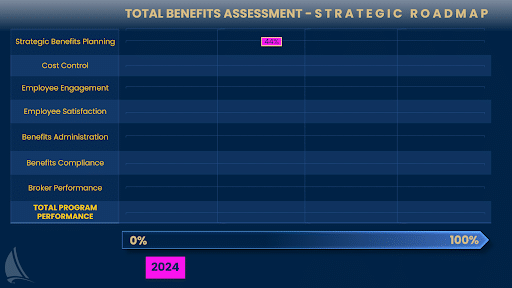

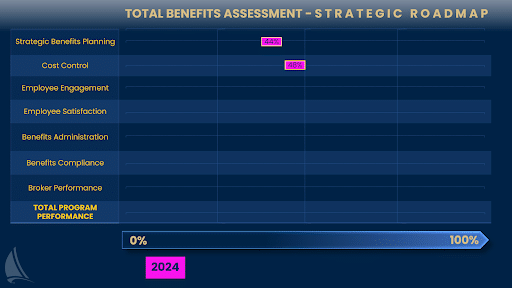

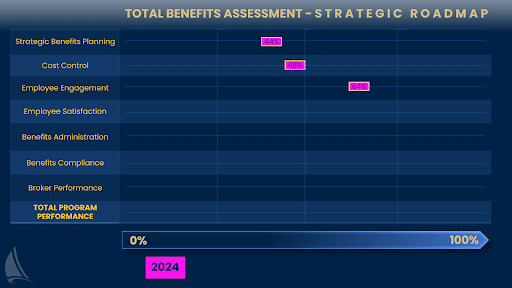

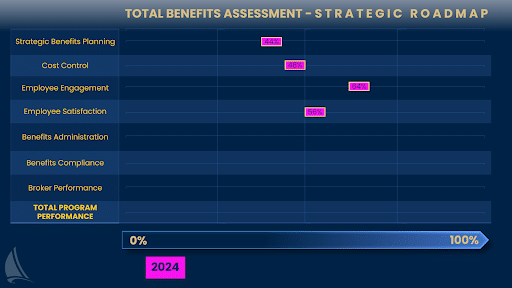

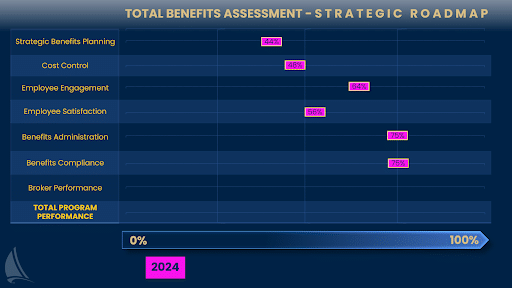

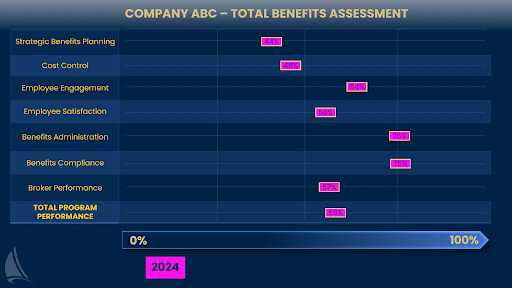

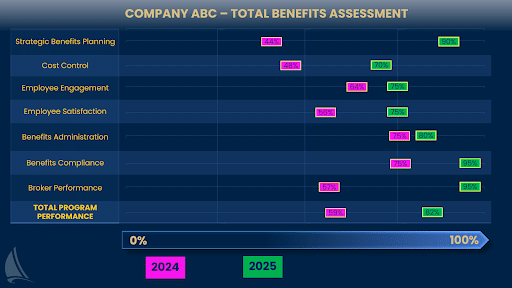

We broke the value equation into the following categories:

- Strategic Benefits Planning

- Cost Control

- Employee Engagement

- Employee Satisfaction

- Benefits Administration

- Benefits Compliance

- Broker Performance

The total benefits assessment quantifies each category, and the sum of these pieces creates the total program performance score.

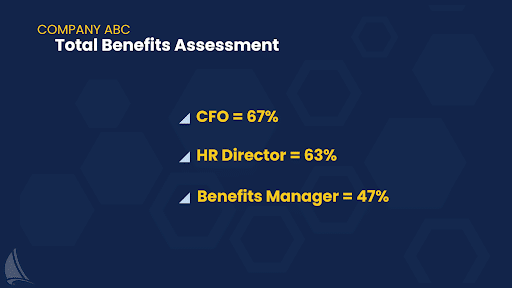

Typically, we have several organizational stakeholders complete the pre-sales assessment, which we’re showing you today.

This is the beginning of our sales process, and it’s important to note that after prospects become clients, we take them through a deeper assessment process.

The pre-sales version of the total benefits assessment is great because it allows prospects to quickly see how their program is

performing, identify opportunities, and set goals for improvement.

In the example listed here, we had a CFO, HR Director, and Benefits manager complete the pre-sales assessment.

The assessment presents a statement for each category of value, and respondents rate themselves on a scale from 0 to 4.

“4” means the statement is absolutely true, and “0” means the statement is absolutely not true.

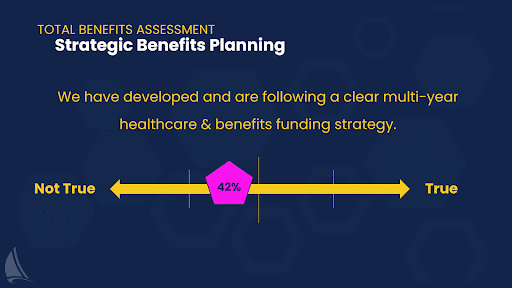

The strategic benefits planning category poses the following statements:

“We have developed and are following a clear multi-year healthcare and benefits funding strategy.”

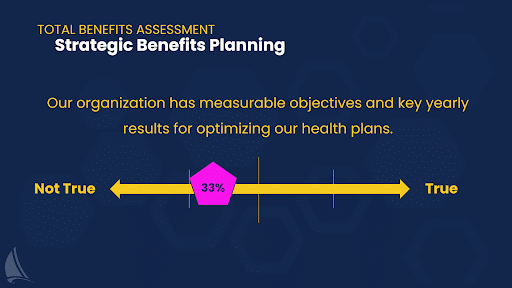

“Our organization has measurable objectives and key yearly results for optimizing our health plans.”

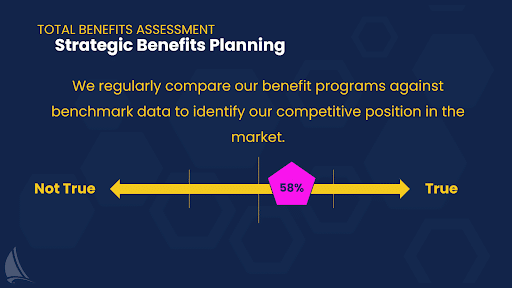

“We regularly compare our benefit programs against benchmark data to identify our competitive position in the market.”

As far as strategic benefits planning goes in this example, the cumulative score for this group was 44% out of 100.

It doesn't mean that anyone is doing anything wrong…it just means that there is an opportunity and business case for improvement.

When we look at the cost control category, the answers to the following statements give us clarity on what kind of financial exposure the employer is subjecting themselves to.

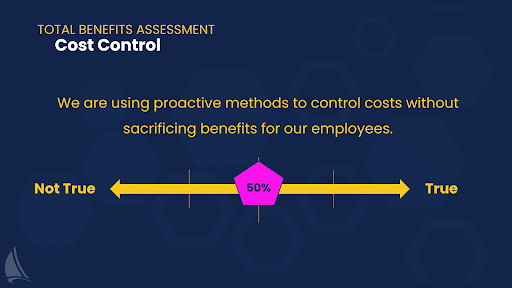

“We are using proactive methods to control costs without sacrificing benefits for our employees.”

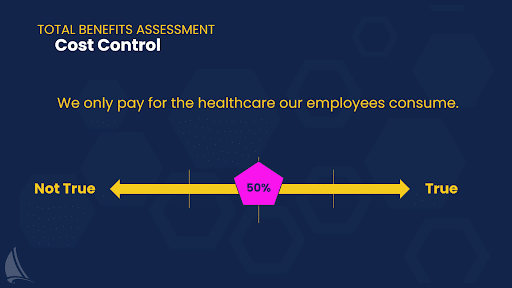

“We only pay for healthcare our employees consume.”

This question is crucial because we often find that regardless of the funding mechanism being used (fully insured, level-funded, or self-funded), employers inadvertently pay for healthcare their employees never consume.

Since most employers are experience-rated (the frequency and severity of their medical and prescription claims dictate their total exposure and insurance premiums), this waste drives up rates each year.

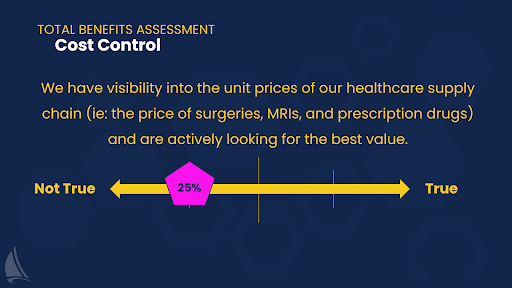

“We have visibility into the unit prices of our healthcare supply chain (i.e., the price of surgeries, MRIs, and prescription drugs) and are actively looking for the best value.”

This aspect of purchasing is critical because if employers and patients don’t have pricing information, it’s impossible for them to apply discipline toward purchasing decisions.

Although new regulations are increasing price transparency for purchasers, most patients still have no idea what healthcare services cost.

As a result of this opaque market, healthcare prices vary wildly.

For example, in Central Florida, healthcare prices vary over 1,000%.

This results in some patients buying MRIs for $6,000 from a hospital when they can be bought for $600 a couple of miles away.

Given that healthcare is a top 3 expense for most companies, this price variance presents a massive opportunity for employers who know how to couple pricing data with effective plan designs.

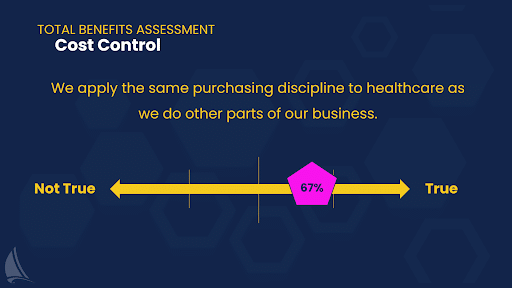

“We apply the same purchasing discipline to healthcare as we do other parts of our business.”

Again, without access to healthcare pricing and quality information, purchasing discipline cannot be applied to healthcare supply chains.

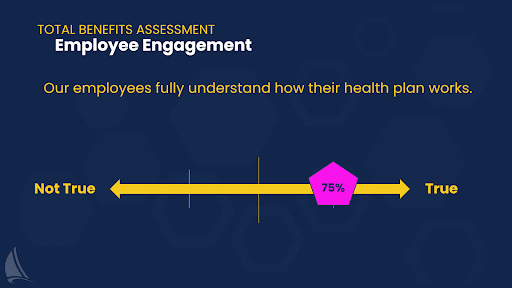

The category of “employee engagement” poses the following questions or statements:

“Our employees fully understand how their health plan works.”

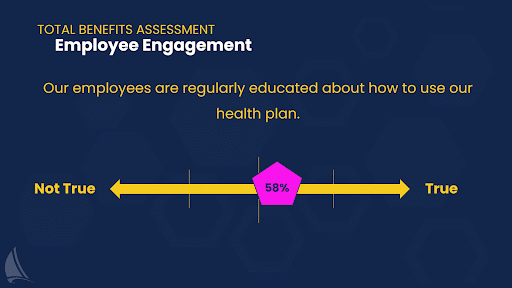

“Our employees are regularly educated about how to use our health plan.”

Hint: if your benefits firm only educates employees once a year during open enrollment, employees probably don’t fully understand how to use their plan. This often results in lost productivity at work, employee dissatisfaction, financial waste — and even poor clinical outcomes.

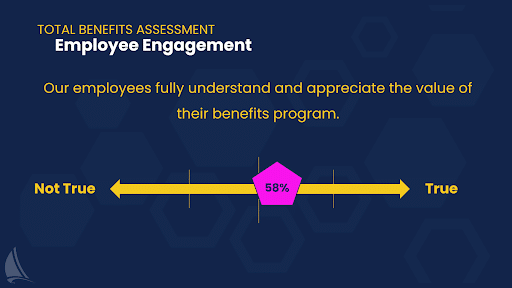

“Our employees fully understand and appreciate the value of our benefits program.”

“In my prior lives, working in the account management and benefits management space, I always felt like one of my main jobs was educating employees about how to use the benefits program and reinforcing the program's value.” - Maurice Clarke

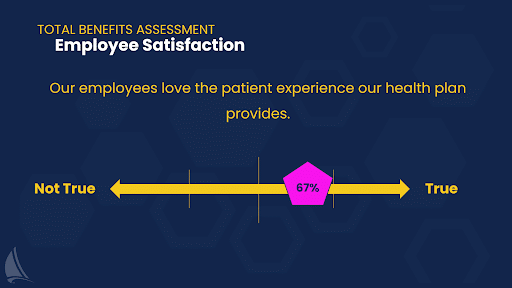

The next section of the Total Benefits Assessment covers “Employee Satisfaction.”

“Our employees love the patient experience our health plan provides.”

“You can have the most cost-effective health plan in the world, but if the patient experience is poor, it’s all a wash and poor experiences spread like wildfire throughout employee populations” - Maurice Clarke

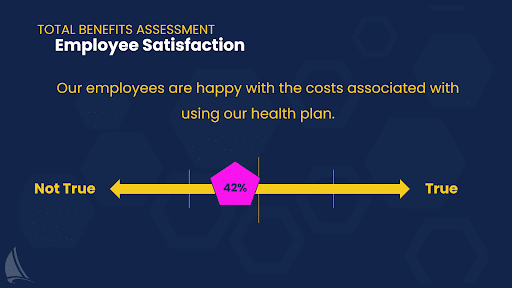

“Our employees are happy with the costs associated with using our health plan.”

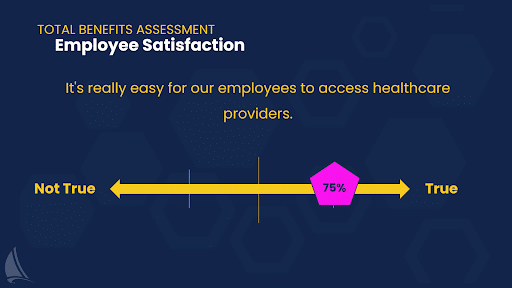

“It’s really easy for our employees to access healthcare providers.”

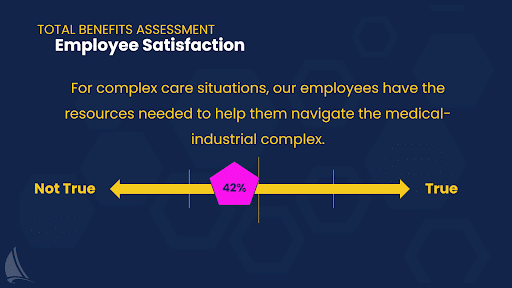

“For complex care situations, our employees have the resources needed to help them navigate the medical-industrial complex.”

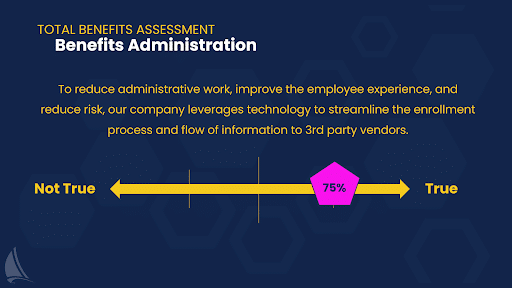

The next section of the Total Benefits Assessment covers “Benefits Technology.”

“To reduce administrative work, improve the employee experience, and reduce risk, our company leverages technology to streamline the enrollment process and flow of information to 3rd party vendors.”

Obviously, benefits administration technology is a heavy focal point for HR teams.

The benefits administration system needs help educate employees by storing plan information, employees to make any adjustments to their health and welfare eligibility.

It needs to be intuitive and remind employees and admin teams when dependents age out of products. It also needs to connect to the many third-party vendors that make up a benefits portfolio and provide a great user experience for both employees and administrators.

Given the increasing compliance requirements employers are subject to, the system also needs robust reporting capabilities that make it easier for administrators to gather the data needed for compliance.

If you’re not leveraging technology, you’re not increasing your administrative costs but potentially putting yourself out of compliance as well.

All of these things undermine business value.

It’s important to note that many brokers attempt to win business by offering “free” benefits administration technology to clients. However, the practice of carving out benefits administration away from payroll often backfires and results in even more manual work for plan administrators.

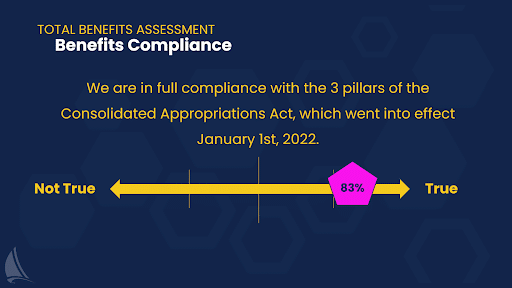

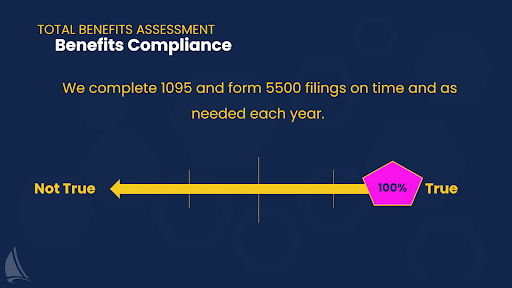

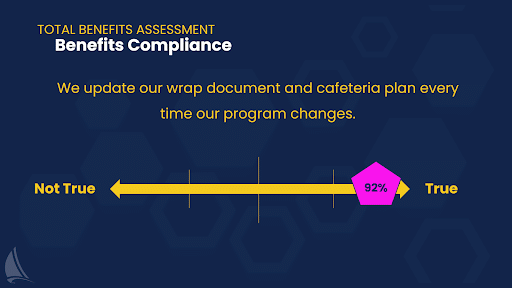

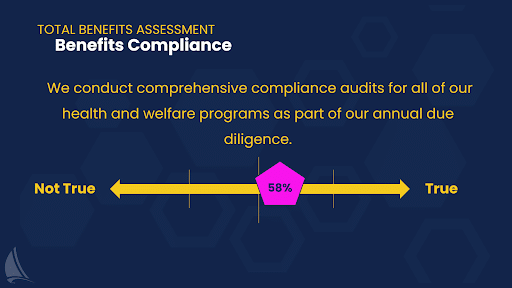

The next section of the Total Benefits Assessment covers “Employee Benefits Compliance.”

“Benefits compliance is increasingly becoming the bane of most employers. Am I going to get a letter from the IRS or DOL?

Employers are rightfully concerned that no one actively monitors their programs for compliance risk because the regulatory environment keeps changing. Seeing that many employers don’t have an actual contract with their benefits firm that clearly outlines the scope of service, many employers are unsure of who is responsible for what and when.

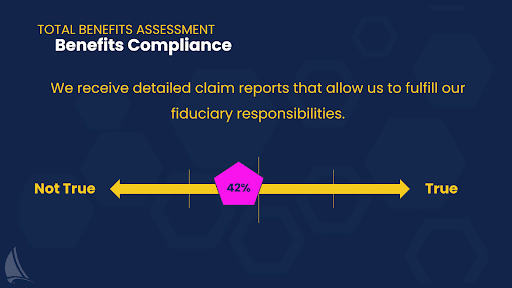

We find that many employers still need to be educated about the fiduciary responsibilities bestowed upon them by the Consolidated Appropriations Act, which went into effect on January 1st, 2022.

Furthermore, they need to be educated about the three pillars of the fiduciary standard. In other words, contracts and arrangements between the plan and vendors need to be transparent and financially aligned, and the plan must make decisions that are in the plan's and its members' best interest.

That said, it’s no longer acceptable for employers to use benefits brokers for advisory services or have them manage the vendor RFP process.

This is because the vast majority of benefits brokerage firms accept compensation from vendors in the form of commissions and bonuses, which conflict with the new fiduciary standards.

That being said, employers need to hire a 100% fee-based benefits consulting firm for advisory and/or RFP services or entirely replace their broker with a 100% fee-based benefits consulting firm.

The fines can be significant, and you really need to have a whole different mindset when it comes to ensuring you, as the planned sponsor, comply with all the different aspects of your health and welfare plans.” - Michael Salcedo, Chief Strategy Officer.

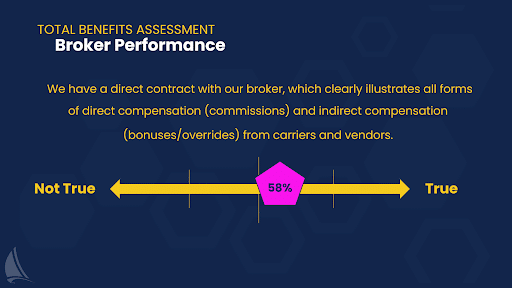

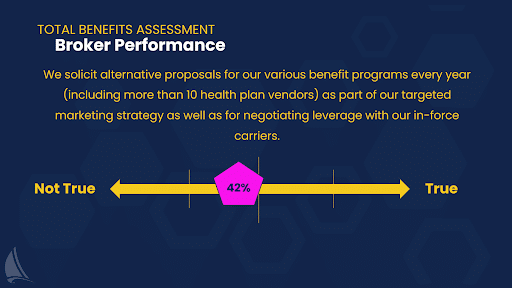

The last section of the Total Benefits Assessment covers “Broker Performance.”

If you – as an employer – do not have a direct contract with your broker that clearly illustrates all forms of compensation being paid to the broker from vendors, you are out of compliance. The Federal Government divides this into two buckets: direct compensation (fees and commissions) and indirect compensation (bonuses, overrides, trips, etc).

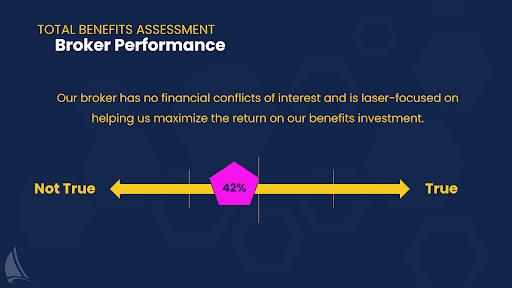

It’s estimated that approximately 20% to 30% of large brokerage firm revenues come in the form of bonuses and overrides. This is particularly important because it undermines brokers' ability to give their clients unbiased, objective advice about how health plan dollars should be invested.

By default, this financial conflict of interest puts anyone who uses brokerage firms for advisory and/or RFP services out of compliance with fiduciary standards that went into effect on January 1st, 2022.

Again, if you don’t have a contract with your benefits firm, it becomes really challenging because you don’t know how they get paid and what financial conflicts of interest they may have. Secondly, if you don’t have a contract with them, you probably don’t have clarity on their scope of services, which creates confusion amongst administrators and can unintentionally expose your company to more compliance risks.

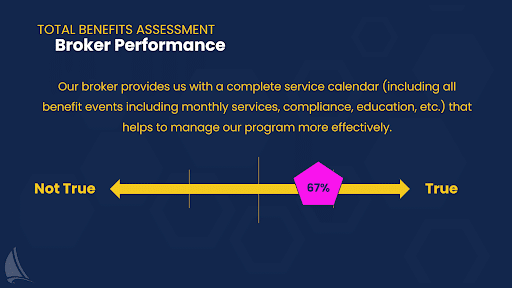

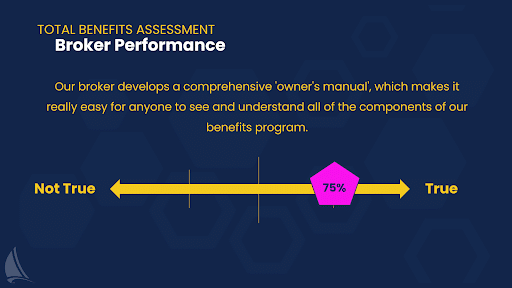

If your broker hasn’t provided you with a clear benefits management calendar and administrator’s manual for the program, it’s really easy to lose track of who is doing what and when.

Regarding the health plan RFP process, if your broker is just showing you proposals from the same four or five carriers each year, you’re really missing out on a whole world of opportunity.

Contrary to popular belief, the marketplace of health insurance products is vast and extremely dynamic.

Even if you’re a small company with under 50 employees, there are over a dozen productized carrier products that your broker should be getting proposals from. This certainly doesn’t mean that each carrier’s product is a fit for our organization. Regardless, your broker should be using their proposals for leverage in negotiations with your existing carriers.

As you can see, the sum total of your benefits program’s value equation produces the total performance score.

The beauty of this framework is that it allows you to quantify different categories of value, identify opportunities for improvement, set clear goals, and develop a road map needed to achieve them.

Companies that score under 90% often waste over $1,000 per employee per year, exposing themselves to compliance risks and undermining their ability to attract and retain the talent needed to meet their business objectives.

Ultimately, a framework like Health Compass Consulting's Total Benefits Assessment results in higher profit margins, higher employee retention rates, and increased business value.

While qualifying companies can begin working with Health Compass Consulting virtually anytime throughout the plan year, our sales process typically takes 45 to 60 days. Therefore, we encourage employers to begin the process well before their renewal period, as this ensures the best client experience.

Take the first step in maximizing the return on your benefits investment by taking the Total Benefits Assessment today.