HR Leaders have heroically navigated the global pandemic, but new challenges are emerging.

Donovan Pyle is a Registered Employee Benefits Consultant and Certified Health Value Professional. He sits on the board of the Health Council of East Central Florida and is the CEO of Health Compass Consulting in Orlando.

In the wake of the global recession and pandemic, employers are looking to optimize their company health plans --- and for good reason. According to a recent Brookings study published in the Wall Street Journal, the Biden administration’s first stimulus round alone will push the jobless rate as low as 3.2% in late 2021. Compounding this, a whopping 40% of employees are considering leaving their job in 2021 according to this year’s Microsoft World Trend Index. This means that in order to avoid massive turnover and business disruption over the next 12 months, employers need to develop a strategic plan to retain talent.

Why is retaining talent important? Well, according SHRM best-selling author and turnover expert, Dick Finnegan from C-Suite Analytics, “it is likely that employee turnover and cost of employee disengagement ranks among each company’s top-five costs”. Since the goal of most corporate health plans is to attract and retain talent, now is the perfect time to re-think your company’s approach.

Five Steps For Success:

1. Clarify the purpose of your program

Whether your plan is new or you're revamping an existing program, the first step is to clarify the purpose of your health plan. Most companies offer healthcare benefits because it’s the most economical way to attract and retain talent, but this is only true if their investment is fully optimized and actively managed by benefits brokers to deliver maximum value to employee populations.

2. Optimize your healthcare investment

The second step is to work with your independent brokerage firm to discover which healthcare financing and procurement model works best for your organization today and how it will evolve over the next 3 to 5 years. If your financing, procurement, and risk management strategies are effective, you will be able to improve benefits while reducing costs. If you’re looking for inspiration, one need not look further than our own backyard where companies such as Rosen Hotels, McCoy Federal Credit Union, and even well-known sports bars have consistently delivered more value to their employees for a fraction of what their competitors pay. Getting quotes from standard markets for pricing is easy, but many groups gain much greater optimization from the development of custom plans that measurably and consistently reduce risk while improving benefits for populations. Not only should your broker build you several custom plans with various levels of risk management, but they should be actively managing your plan throughout the year to identify where additional risk management interventions are needed. For example, if you see an increase in specialty medication use, there’s no reason to wait until your renewal period to find a more cost-effective way to procure those medications.

3. Understand your competitors

The metaphorical talent war is on and as Sun Tzu famously said, “If you know yourself but not the enemy, for every victory gained you will also suffer a defeat.” If talent acquisition and retention is your goal, then you’ll want to understand what your competitors are doing and make a calculated decision about what your company’s premium contribution should be. Work with your independent benefits broker to develop a contribution strategy that is equitable, sustainable, and supports your goals.

According to the 2020 Kaiser Family Foundation (KFF) Health Benefits Survey, employers contributed an average of:

- $6,227 for single coverage. Employees contributed $1,243.

- $15,754 for family coverage. Employees contributed $5,588.

Of course this varies greatly depending on your geographic location, population, plan design, and risk management interventions.

4. Develop a multi-year strategy

To help align your health plan with company goals, develop a multi-year strategy that consistently and predictably reduces costs while improving benefits for employees. This can mean replacing vendors with those whose financial interests align with yours, or adding risk management solutions to your program. Either way, a multi-year approach will allow Chief Financial Officers to more accurately predict costs and reduce administrative work for HR leaders at renewal time.

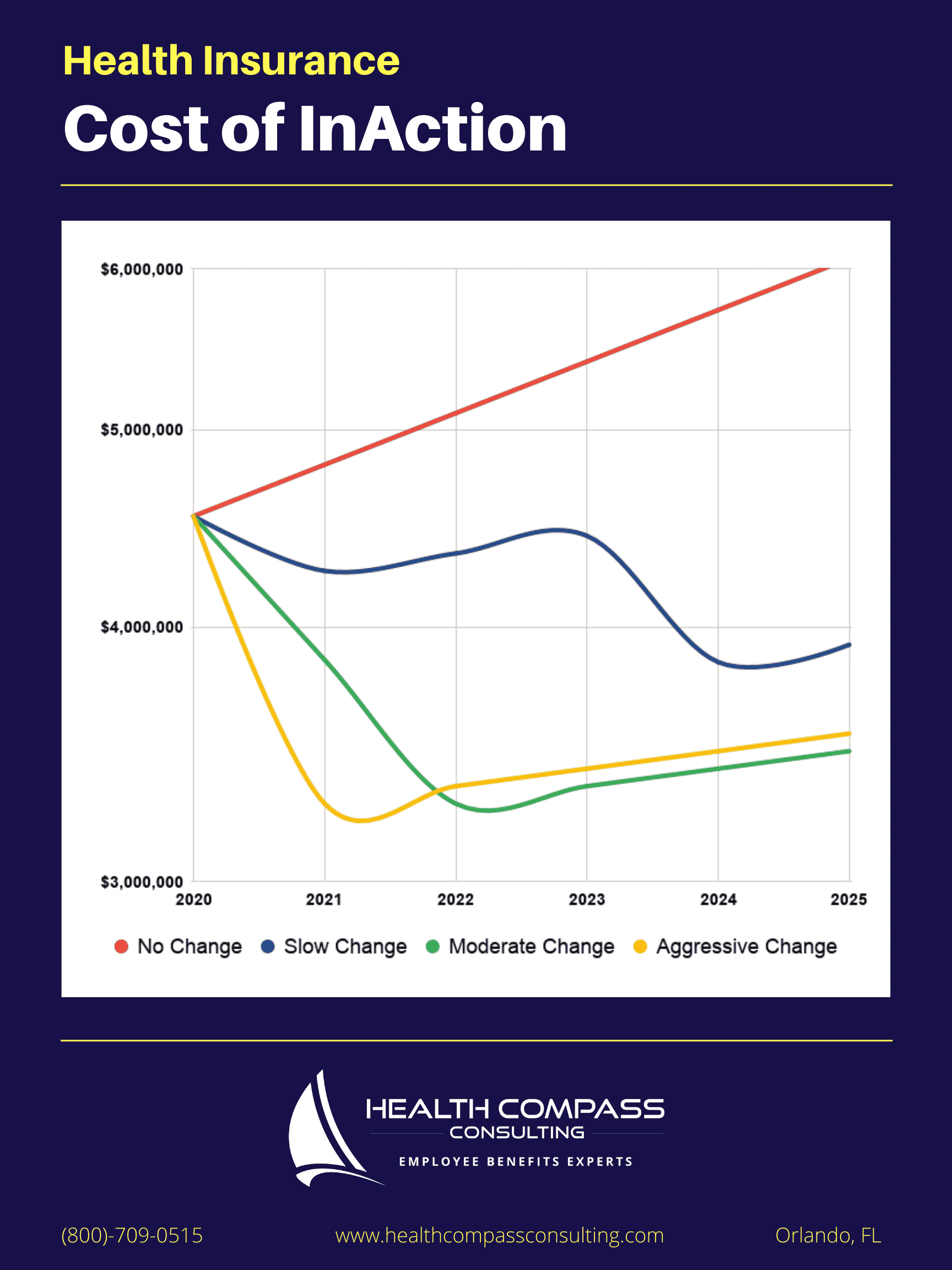

The chart below illustrates how much money many mid-size organizations can save while maintaining or improving benefits and network access for employees.

5. Implement, market, and actively manage your program

After a direction has been chosen, it’s time to implement! Your enrollment meetings should be joyous and fun. Why? Because if you’ve optimized your plan effectively, you should have lots of good news to share with your employees! Perhaps you’ve eliminated some copays on the plan, or maybe you improved provider access or reduced their premium share --- effectively giving them a raise. These are all things to be celebrated.

After your enrollment is complete, your benefits broker should launch the marketing campaign they designed for your company that continuously educates employees about how to use your plan and its value to them. Your broker should also be actively managing your health plan throughout the year to identify opportunities to guide employees toward high-quality healthcare providers that reduce physical and financial risk.

As the labor market heats up and employees continue to weigh their new work-from-anywhere employment options, employers will increasingly need to leverage human resource departments to retain the employees needed to achieve company goals. Overworked HR professionals who step up to the plate and take the extra steps needed to optimize health plans will undoubtedly give their organization an advantage over those who press the “easy-button” and hope for the best.