FaqS

Understanding the intricacies of healthcare financing and procurement methods, healthcare supply chain management, and the ever-changing regulatory environment should not be left to brokers who merely possess an insurance license.

Verify that the specific broker or consultant you will be working with has the highest designations and certifications in the benefits industry, as this is akin to having a Ph.D. in other sectors.

They are as follows:

- Certified Health Value Professional (CHVP) - awarded by the Validation Institute.

Registered Employee Benefits Professional (REBC) - awarded by the National Association of Benefits and Insurance Professionals. - Certified Employee Benefits Specialist (CEBS) - awarded by the International Foundation of Employee Benefit Plans

If you’re considering replacing your broker with a fee-based firm, the short answer is “No.” When fee-based consulting firms get quotes from traditional Carriers, they instruct Carriers to remove commissions from the product. Instead of the 4%-6% commission paid by Carriers to brokers, fee-based firms often charge a flat fee that ranges from $25 - $60 per employee per month, depending on which services the firm includes in their service package.

While fee-based firms may generate slightly more or less revenue than traditional brokerage firms, it’s important to remember that the value created from getting objective investment advice far exceeds any slight compensation deviations between brokers and fee-based consultants.

For example, if an employer with 100 employees spends $1 million yearly on their health plan, a broker would normally receive 5% ($50,000/year) in commission.

Even if the fee-based firm charged the employer $75,000 ($25K more than the broker was getting in commissions), but their recommendations saved the employer $100,000 on their plan, the employer still netted $75,000 in savings for a product of equal or better value.

Yes.

Although these services require a financial investment, most fee-based benefits consulting firms eliminate all risks for the employer by providing several types of guarantees.

Here are the types of guarantees fee-based benefits consulting firms typically offer to eliminate risk for employers:

- A minimum return on the initial investment.

- A satisfaction guarantee.

- Crediting the evaluation fees towards the first year’s benefits management fee.

- Charging a percentage of the savings created in place of a fee (i.e., if the benefits firm’s recommendations result in $1 million in savings, the employer will pay the firm a percentage of those savings).

Yes, a fee-based benefits firm can replace your broker.

Yes, a fee-based benefits firm can replace your broker.

Brokers and fee-based firms have access to the entire marketplace of insurance products. Unlike brokerage firms, fee-based firms are not financially penalized for maximizing the return on an employer’s benefits investment. They are laser-focused on helping their clients achieve their business objectives.

Broadly speaking, fee-based firms save employers money by 1) showing employers how to stop paying for healthcare employees never actually consume and 2) showing employers how to stop overpaying for the healthcare their employees do consume.

Absolutely not. Since some Carriers pay brokers more than others, it is challenging for brokers to give employers objective investment advice about which products to buy. Furthermore, employers who work with benefits professionals whose financial interests are misaligned with theirs are more likely

to purchase products from vendors whose economic interests are also misaligned with theirs. Seeing how vital aligning financial interests is to maximize a company’s health investment, fee-based consultants are

Absolutely. According to the Consolidated Appropriations Act (CAA), starting January 1st of 2022, all brokers and consulting firms must have a contract with employers. This contract must disclose all forms of direct compensation (commissions and fees) and indirect compensation (bonuses from Carriers) paid to the broker or consulting firm.

No, you do not have to change your benefits when changing benefits firms. Organizations usually want their new firm to procure or build options for them, but it’s essential to understand that none of your benefits have to change unless you want them to.

Although you can switch firms during your renewal period (the three months before your renewal date), it’s often best to change firms far before that date. Unfortunately, in practice, many companies usually wait until they get a lousy renewal from their health insurer before looking for a new firm. Waiting until

a bad renewal makes it more difficult to find a better solution for your organization. Starting a new benefits management relationship during a difficult renewal is also stressful. While it’s only natural for pain to force change upon us, objectively, it’s best to develop a multi-year strategy and determine your options well ahead of having to endure that pain.

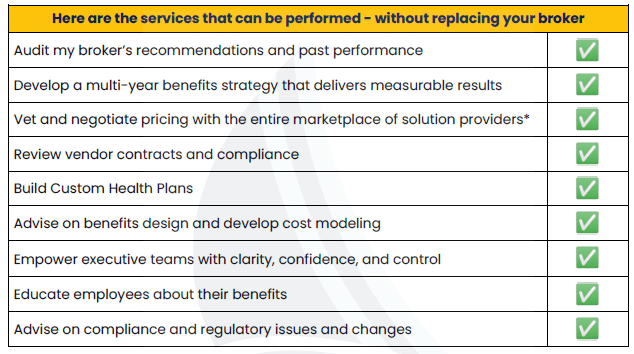

Yes, employers can hire fee-based firms to check their broker’s work, build high-performance health plans, recommend bolt-on risk management solutions, or be available for ongoing consultation through a retainer.

No, and as benefits consultant Craig Lack famously observed, “If size were a proxy for quality, the clients of national brokerage firms would never see a rate increase – but they do.” Organizations must understand that big-box agencies work for insurance carriers and vendors – not employers. They market themselves as buyer’s agents but get paid like seller’s agents. Their business model heavily relies upon year-end bonuses from insurance carriers and vendors. This compensation is usually undisclosed and often paid to separate holding companies to evade contractual restrictions with clients. The compensation carriers and vendors pay agencies are highly problematic

because it clouds their objectivity and influences the recommendations they make to clients.

By contrast, fee-based firms – which tend to be small -- are free from external control or the authority of another. This revenue model liberates fee-based firms to sit on the same side of the proverbial table as their clients and provide them with objective advice. It’s also important to note that both fee-based firms and big-box agencies can access the entire marketplace of insurance products and

the ability to build custom plans.

The difference is that fee-based firms are not financially penalized for making recommendations that maximize the return on their client’s benefits investment. To use a metaphor, while it is true that Mcdonald's sells more hamburgers than anyone else each year, you’d be hard-pressed to find someone who thinks Mcdonald's makes the best hamburger.

When an employer designates a firm as their "broker of record," they are granting that firm the power to act as their representative and manage their policy on their behalf.

For brokerage companies, being assigned as the broker of record is how they receive payment from the insurance carrier for all commissions, overrides, and bonuses. While fee-based benefits consulting firms are not required to be the broker of record for payment purposes, they must be designated as such in order to manage and represent your relationship and policy with insurance carriers.

In today’s world, the words “broker, consultant, advisor, and independent firm” are often used interchangeably. However, there are some important distinctions to keep in mind. Although traditional brokerage firms (often publicly traded) and fee-based firms usually have access to the entire marketplace of off-the-shelf insurance products, brokers receive compensation from insurance carriers and vendors through commissions and bonuses. Since some insurers and vendors pay brokers more than others – and all carriers pay brokers bonuses based on their book volume, it’s difficult for brokers to recommend best-in-class solutions for their clients objectively. In other words, traditional brokerage firms market themselves as buyer’s agents but get paid like seller’s agents.

No, and it should be pointed out that in the fully-insured small group market (less than 50 eligible employees), most States already mandate Carriers to pay brokers and fee-based firms a flat fee (usually on a per-employee, per month basis) in place of commissions. While this is advantageous for employers, the challenge is that most States have not mandated that the fees be the same

for each Carrier. Since some Carriers pay higher fees than others, there are occasionally situations where both brokers and fee-based firms are financially penalized for making better recommendations to their fully-insured small group customers.

The difference in fees paid by health insurers is a regulatory challenge affecting brokers and fee-based firms. Regarding ancillary lines of coverage, brokers and fee-based firms usually accept commissions on these ancillary services. This is because these lines of coverage are often employee-paid; therefore, charging a fee for these services would require charging employees or the employer separately. In either case, this is undesirable, so brokers and fee-based firms usually get paid commissions on

ancillary services.

In many cases, the answer is “yes.” Most plan administrators can wrap fees into the insurance premiums for level-funded and self-funded plans and remit payment to the firm out of those premiums. This is advantageous because it reduces administrative work for employers and fee-based firms. When employers purchase fully-insured health insurance products, fees cannot be wrapped into these premiums. Therefore, employers will need to pay their benefits firm directly.

Yes, some fee-based firms will put part or all of their compensation at risk. This performance-based model is advantageous for employers because it aligns incentives between stakeholders.

The short answer is “No.” Most fee-based firms work with all the traditional products as well as a broader range of risk management strategies and solutions than brokerage firms.

Check your contract with your firm, but most fee-based firms credit Carrier bonuses to the employer.

If you don’t have a contract with your benefits broker, you are violating the Consolidated Appropriations Act. Although carrier bonuses are typically paid to the firm — not the individual broker or consultant, all forms of compensation paid to the firm must be disclosed in your contract with them.

This is a critical question. The process and people involved will determine if a good business decision is made. We strongly encourage giving middle managers a voice, as you’ll need their commitment to helping implement and champion whatever direction you choose. However, we recommend that only those with P&L responsibility should have a vote. Whatever process you choose, it must align with your company’s culture.

This can vary greatly. Some fee-based firms make guarantees in their service agreements, and some take on financial risk based on the performance of the health plans they build and manage.

No. Although self-funding has become an increasingly popular way to gain control and reduce expenses, self-funding isn’t suitable for every company. Luckily, there are other ways fee-based benefits consultants can optimize more traditional health plans without the hassle of self-funding.