Company Overview & Results

Thesis | Process | Results

MISSION

Our mission is to eliminate the $300 billion employers waste on healthcare each year so that they can attract and retain the talent needed to achieve their goals.

VISION

Our vision is for organizations and individuals to have the economic freedom and stability needed to pursue their dreams.

A lot of people have been asking about how Health Compass is a new type of professional services company that is challenging the employee benefits brokerage industry to help employers achieve their objectives.

I am sharing a video that will answer a lot of questions about how we're different, what our process is like, and what kind of results we can achieve.

Our origin story goes back to 2018. After spending a number of years in the employee benefits industry, I was actually fired by a large health insurance brokerage firm for helping our clients achieve their business objectives.

That next week, I founded Health Compass to bring sanity back to the employee benefits industry.

The thesis for our company is that the brokerage industry shouldn't exist.

That's why I founded Health Compass.

It's not that employers don't need help understanding how to maximize the return on their employee benefits investments.

They absolutely do, and that's why 81% of businesses use a benefits firm.

But historically, what employers expect and what they get are often two different things.

If we were to prioritize what employers really want out of a benefits firm, they want them to…

1. Maximize the return on their benefits investment.

2. Keep them compliant…there's a ton of regulations out there that are changing and evolving, so that's a big concern.

3. Educate their population about the value of their program and how to use it.

4. Help them leverage technology to reduce the administrative burden of their program.

That's what they expect from a benefits firm.

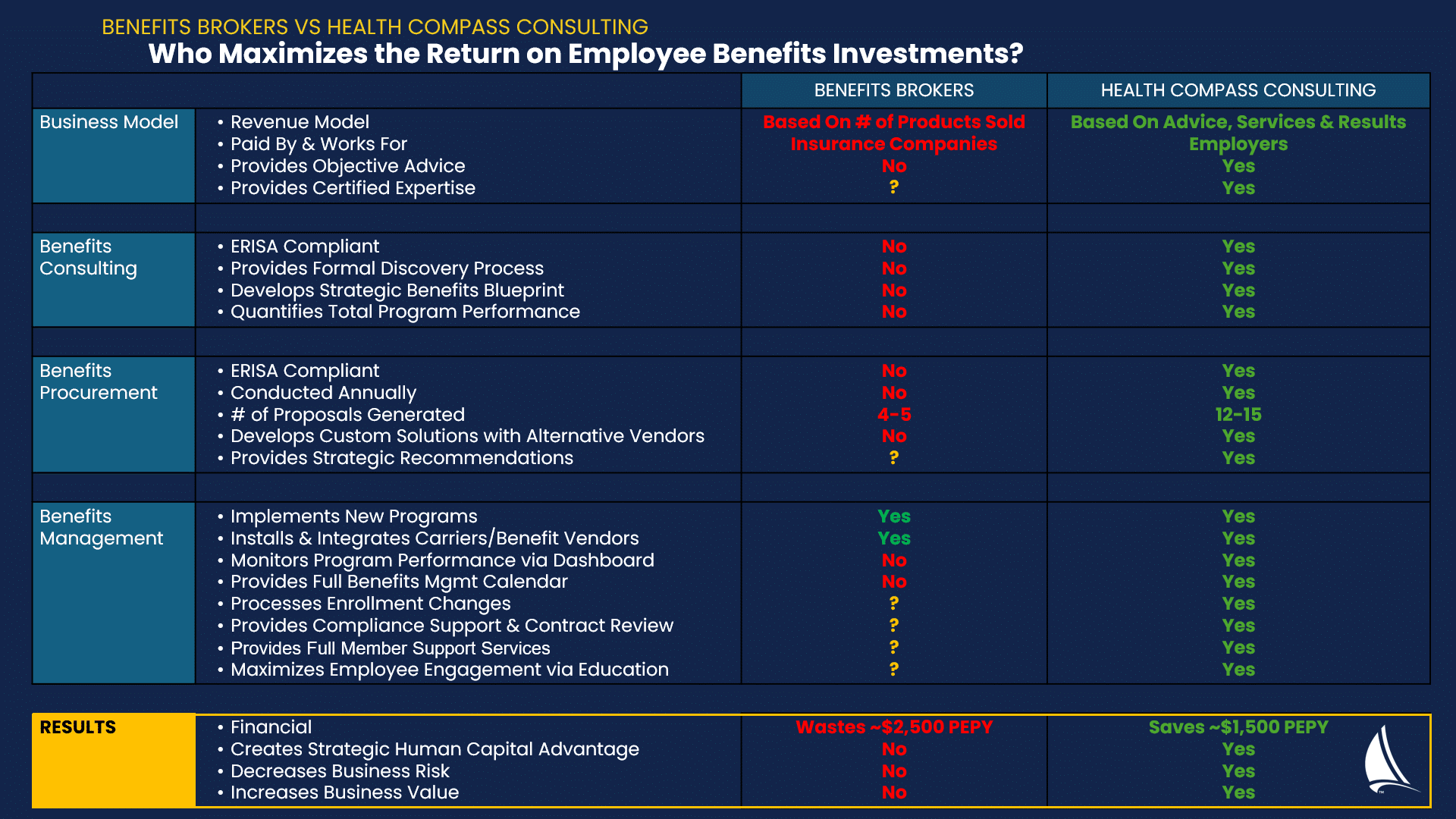

But unlike outside legal and tax service providers, benefits brokers don't work for you.

Benefits brokers work for insurance companies and ancillary vendors.

And that's why they make more money when an employer's costs go up, not down.

This is because they get paid by the insurance companies and vendors in the form of commissions, bonuses, and overrides.

Unfortunately, this misalignment really undermines the biggest reason employers with outside benefits firms: to help them maximize the return on their benefits investment.

This dynamic is as absurd as working with a CPA who gets paid by the IRS. You would never do that because you’d be guaranteed to pay more taxes than you should.

Relying on benefits brokers for consultation on how to maximize the return on your benefits investment and/or manage your RFP process is equally absurd, and that’s why ERISA law prohibits it.

Benefits brokers have so much influence over the rest of the supply-chain and how healthcare dollars are spent, and this is a major reason why the average employer wastes about $2500 per employee per year on healthcare.

The “fox” is not very good at guarding the hen house.

Seeing how detrimental it is to consumers when a benefits firm’s revenue is tied to the sale of a financial product, I was very intentional about creating a business model that allows us to give our clients objective, unbiased advice about how to maximize the return on their benefits investment.

Replacing the failed product-based revenue model with a fee-based managed services model is really the secret to our customer’s success.

In other words, we simply charge our clients a flat fee for benefits consulting and management services, which completely changes our client relationship dynamic.

By doing so, Health Compass became one of the first fee-based, carrier-agnostic benefits consulting firms in the United States.

This unconflicted approach to benefits consultant consulting and procurements allows employers to fulfill their new fiduciary responsibilities under the Consolidated Appropriations Act, which went into effect January 1st, 2022, and, as a byproduct, maximize the return on their benefits investment.

Health Compass’s fiduciary-based revenue model combined with our certified expertise, years of experience, and proprietary framework for continuous improvement (the Total Benefits Assessment from Health Compass Consulting) is what delivers results for our clients.

Our mission is to eliminate the $300 billion that employers waste on healthcare every year so that they can attract and retain the talent needed to achieve their goals.

That's our mission.

Our vision is to create a world where organizations and individuals have enough economic freedom, confidence, and stability to pursue their dreams, right?

Our leadership team consists of myself our Chief Strategy Officer Michael Salcedo, a 27-year industry veteran in Tampa. Michael worked for all the big-box benefits firms and most notably led the employee benefits practice at Zenefits before joining Health Compass in 2024.

Also with us is Maurice Clarke, who worked at Aon managing their mid-size book of business for about eight years and then managed benefits for Darden Restaurants and their 180,000 employees for about nine years before joining Health Compass Consulting in 2022.

For those of you keeping score at home, Health Compass is one of the few benefits consulting firms in the country with the highest certification and designation in the employee benefits industry.

These qualifications are essential because, as many employers have figured out, benefits professionals without these certifications are more likely to create risks than manage them.

Our thought leadership can be seen in national publications like Yahoo Finance, SHRM and local publications like the Orlando Business Journal.

We're making a name for ourselves by showing employers how to maximize the return on their benefits program, which often saves over $1000 per employee per year while improving benefits for their population.

And, yes, we actually wrote the book on how to choose the right fee-based benefits consulting organization firm for your organization — which was endorsed by the Validation Institute in 2023.

The Validation Institute is one of the governing bodies that issues one of the highest certifications in the benefits consulting industry.

Let's switch gears and talk about our two service models.

In our benefits consulting model, we serve as the architect for your benefits program. In other words, our process is to assess your current state and survey your stakeholders so that we understand your organization at a very deep level. This means that we understand your organization’s perceptions of risk, business objectives, and, just as importantly, tolerance to change.

After taking the time to understand these dynamics, we design the multi-year strategy (aka benefits blueprint) that helps you achieve your human capital and business objectives.

This process is critical because if you bring subcontractors without a blueprint and they just start banging on a bunch of nails, they’ll probably end up building a house (i.e., benefits program) that's not very functional, doesn't look very good and costs more than it needs to.

Planning is a huge component of success, so you definitely want to be very intentional about it.

After we’ve presented our recommended roadmap to clients and it’s the appropriate time to implement the first stage of their multi-year benefits strategy, we move clients into our benefits management channel.

This is where we become the general contractor for your benefits program. What does that mean?

It means we’re not administering claims or providing healthcare services for your population.

We are the general contractor that selects and manages the subcontractors (i.e., vendors) who will build your blueprint (benefits roadmap) to spec.

Here's what our sales process looks like:

It’s important to note that organizations can change their benefits firms almost anytime throughout a plan year.

However, it is risky to do this during your renewal period because there are so many other things going on, and the client experience almost always suffers.

Ideally, you want to start vetting benefits firms way ahead of your renewal period.

Our sales process generally takes 45 to 60 days.

It starts with a convenient and effective Total Benefits Assessment, which quantifies the value equation of your benefits program and identifies opportunities for improvement.

After we review assessment results with decision-makers and stakeholders, we spend 30 minutes educating them on the employee benefits landscape.

If, at that point, stakeholders decide they would like a proposal from us, we will customize one and review it with stakeholders to make an effective business decision.

Let's get a little more granular on each part of the assessment, education, and proposal process.

The Total Benefits Assessment from Health Compass is our framework for continuous improvement, and it drives our entire customer journey.

The origin story for this framework is really interesting:

We were doing some M&A work for a mid-size company and finally got all the stakeholders into a meeting to deliver our post-discovery recommendations.

The CEO asked everyone a pretty simple question: “Is our benefits program better or worse than it was two years ago?”.

The stakeholders had a hard time answering that question because no one had ever shown them how to quantify the value equation of their benefits program.

Seeing the complexity and confusion this situation so often results in, we decided to develop a dashboard that quantifies the value equation of benefits programs.

As you can see, we’ve broken the value equation down into different categories of value and through our assessment process created a baseline score of how a the benefits program is performing in each category.

The total of these categories creates the total performance score.

Companies whose total program score is below 90% are definitely leaving money on the table and undermining their ability to attract and retain talent.

After we review assessment results and identify opportunities for improvement, we spend 30 minutes educating stakeholders on the employee benefits landscape.

This is hugely important because if decision-makers don't have a clear understanding of the different types of vendors, their roles, and their financial incentives, then it's really difficult for organizations to make effective business decisions that fulfill their fiduciary responsibilities, maximize the return on their benefits investment, and achieve their business objectives.

That being said, educating stakeholders on the employee benefits landscape is a vital part of our sales process.

Through this process, stakeholders also discover that the marketplace of employee benefits insurance products, point solutions, and risk management strategies is much bigger than formerly believed.

Not only is the marketplace of employee benefits enormous, but it’s also dynamic and changing every day.

12:19

Here’s just a small sample of some of the vendors most employers have never been exposed to.

By no means does it mean that they are all viable options for your organization, but your benefits firm should at least be using them as leverage in negotiations.

At this point, If an organization decides they want a proposal from us, we will create a custom proposal detailing the scope of our benefits consulting, management services, and pricing.

It’s important to point out that many employers don’t know what their broker gets paid or what services they provide because the broker has never presented them with a contract.

This is simply because brokers don’t work for employers, and this arrangement's opaqueness often results in confusion for both employers and the broker’s service teams.

Clarifying who is responsible for what through a standard contract is an essential business practice that helps employers fulfill their fiduciary responsibilities and maximize the return on their benefits investment.

For companies that want to work with us, here's their client journey with Health Compass.

The first step is to assess their current state through a formal discovery process.

Health Compass developed a formal discovery process because making product or strategy recommendations without discovery is professional malpractice for a consulting firm.

This allows us to identify opportunities for improvement, set goals, and develop a plan to achieve them.

After clients have agreed on a direction, we implement that plan, manage that plan, continuously look for opportunities to improve, set goals, and start the process all over again.

To be clear, Health Compass’s entire client journey is measured and managed through our total benefits assessment dashboard.

It is our framework for continuous improvement.

Let's talk about why all of this matters.

From a financial perspective, Health Compass’s business model and process typically result in clients saving around $1,000 per employee each year — with better benefits.

From a macro perspective, we achieve these results by giving organizations the clarity necessary to apply purchasing discipline to healthcare supply chains. We teach them how to stop paying for healthcare employees who never consume and how to stop overpaying for the healthcare the employees do consume.

It’s not magic…it just requires visibility into how healthcare supply chains work.

Optimizing one of your company’s biggest expenses can then be leveraged to give your organization a strategic advantage in the war for talent. In other words, you’ll have the margins necessary to pay better wages, have better benefits, and build a better culture. These are essential for attracting and retaining talent to fulfill your business objectives.

Lastly, Health Compass’s highly operationalized process reduces compliance risks.

Employers who want to fulfill their fiduciary responsibilities must follow Health Compass's unconflicted approach to benefits consulting and RFP management. This approach not only

helps them comply with an ever-changing list of compliance requirements but also brings to light the compliance requirements that are usually hidden from organizations.

So, what’s the net result of this alignment, process, and individual value propositions?

To summarize, Health Compass helps organizations achieve their objectives and increase business value.

For example, a company that works with a benefits broker might sell for five times EBITDA.

This same company that works with Health Compass Consulting might sell for seven times EBITDA.

Ok…let’s look at a few case studies:

Judy Nygying is the past Vice President of the Seminole Education Association.

They brought us in to help their members understand the employee benefits landscape and identify opportunities in their $65 million dollar health plan.

Through our assessment process, we found that their district hadn’t gone to RFP for a new pharmacy benefit manager (PBM) in seven years.

The Union encouraged the District to go to RFP for a new PBM, and as a result, they are saving $3.6 million by simply replacing one vendor in their health plan.

Another example is Champion Solutions Group, a technology company down in South Florida.

We completely revamped their health plan, which saved them over $3,000 per employee—with better benefits—that first year.

The following year, they were able to sell for a multiple that made the owners happy.

Going down market a bit…Boldist is an excellent marketing digital marketing company in Orlando.

Our agnostic approach to the market gave them access to a health plan that saved them over $1400 per employee the first year while eliminating copays and deductibles for their employees.

For a small business like theirs, this is life-changing.

To wrap it up, if you’re looking for the clarity, confidence, and control needed to fulfill your fiduciary responsibilities and maximize the return on your benefits investment, I encourage you to complete the Total Benefits Assessment from Health Compass Consulting.

It takes about 10 minutes to complete and serves as a great conversation starter because it clarifies the current state and opportunities within your benefits program.

My name is Donovan Pyle. If you have any questions, feel free to contact me or anybody on our leadership team.

Take care.

Our business model, certified expertise, and mission lay the groundwork for your company’s transformation.

But don't just take our word for it... listen to our clients'.

What Our Clients Say About Us

Health Compass was able to guide us and bring about a change with a new Pharmacy Benefits Manager (PBM) that will save the District $3.6 million dollars. This money will now be available to fund raises for our teachers, bus drivers, and all education support professionals. We look forward to continuing the journey.

Judy Ngying - Past Vice President

Seminole Education Association

“Health Compass shopped all the usual carriers, but their custom solution saved us over $1,400 dollars per employee and eliminated copays and deductibles for our team…a solid win all around”

Ben Collins - President, Boldist

“I still hate health insurance, but at least Health Compass saved us over $3,000 dollars per employee and improved coverage the year before our exit"

Chris Pyle - CEO, Champion Solutions Group

Health Compass not only showed us how to reduce costs without compromising coverage, but they also connected us with employers who were looking to work directly with independent healthcare providers like us.

Dr. Edie K. Benner PT, PhD, OCS, President at Advanced Rehabilitation & Health Specialists

“Without Health Compass, our healthcare costs would have increased by more than $1,800 per employee this year. For staffing companies, employee benefits are a complex subject, and Health Compass did a great job understanding our business and finding innovative ways to protect our people and our bottom line.”

Charlie Lewis - CEO, Bluewave Resource Partners

“Very knowledgeable and insightful --- I recommend working with them”

- James Engstrom, Eagle Trace Consulting!

Team

Donovan Pyle, Founder and CEO

While working on the carrier and brokerage side of the employee benefits industry, Donovan Pyle identified a fundamental misalignment in the market: Brokers make more money when their client's costs go up, and this undermines the employers' ability to get objective advice on how health plan dollars should be invested.

The problem inspired Donovan to develop and found one of the first fee-based employee benefits firms in 2018. By working directly for employers instead of vendors, Donovan’s firm — Health Compass Consulting — escapes the financial conflicts of interest that prevent employers from getting the results they desire.

Today, Health Compass's clients have anywhere from 10 to 10,000 employees and save approximately $1,500 per employee per year -- without watering down coverage.

Pyle holds the highest consulting designation awarded by the National Association of Insurance & Benefits Professionals, is the Vice Chair of the Health Council of East Central Florida, and is one of twenty-eight consultants in the U.S. certified by the Validation Institute. He also holds the highest Society for Human Resources Management (SHRM) certification - Senior Certified Professional.

His writing can be seen in Yahoo Finance, SHRM, Seeking Alpha, and many other national publications, and he can be reached at donovan@healthcompassconsulting.com

Michael Salcedo, Executive Vice President & Chief Strategy Officer

Michael Salcedo is a 27-year veteran of the employee benefits industry. Before leading the employee benefits practice at Zenefits and joining Health Compass as its Executive Vice President and Chief Strategy Officer in 2024, Michael served in various roles at AON, Gallagher, BB&T, and others.

Michael is passionate about championing innovative approaches to healthcare delivery, risk management, and operational excellence.

If you’re interested in leveraging Michael’s knowledge and experience, please contact him at msalcedo@healthcompassconsulting.com

Maurice Clarke, Employee Benefits Consultant

Over the course of his 15 year career managing benefits for some of America’s largest brands at Darden Restaurants, Maurice discovered that the misaligned incentives between vendors and employers often resulted in escalating costs for both employers and employees.

As an Employee Benefits Consultant with Health Compass Consulting, he brings clarity, objective advice, and innovative solutions to businesses so that they can improve the financial and physical health of their organization.

If you’d like to learn more about Maurice's approach and thinking, please contact him at:

mclarke@healthcompassconsulting.com

Rick Proctor, Director of Executive Benefits

Over the past 30 years, Rick Proctor has built his career around providing comprehensive executive benefits, insurance, and estate planning solutions to successful businesses and their leaders. He has found that developing long term relationships with clients and strategic partners allows for a more holistic and aligned experience for all parties involved. Rick actively nurtures these relationships, allowing for better outcomes and more innovative, all-encompassing wealth preservation strategies for his clients.

He can be reached at: solutions@healthcompassconsulting.com

Kishan Herriotts, Director of Global Benefits

Based in London and with decades of experience under his belt, Kishan Herriotts specializes in helping U.S. multinationals navigate the complexities of global renewals, compliance/legislative updates and problem solving, ensuring that the global benefits strategy runs without disruption.

His guidance ensures businesses keep pace with the local benefits market in a manner suited to their global strategy.

He can be reached at: solutions@healthcompassconsulting.com

Kenna Ulbinsky, Director of Engagement

For over 10 years, Kenna Ulbinsky has been helping employees customize their benefit packages based on their individual needs, risk tolerance, and budgets.

Her attention to detail and passion for innovation produce exceptional client experiences that make her a much-valued part of the Health Compass team.

Kenna can be reached at: engagement@healthcompassconsulting.com

Emily Ellyn, Director of Marketing

Bunky Garrabrant, Client Success Manager

Carol Hensal, Client Success Manager

A graduate of Kent University and accomplished pianist, Carol Hensal has been delighting clients and audiences for decades.

Carol is passionate about improving the financial and physical health of communities.

She can be reached at: service@healthcompassconsulting.com