100 - 999 Employees

Our 3-Step Process Maximizes the Return on Your Benefits Investment.

01

Set Goals

02

See Options

03

Implement

01

Set Goals

02

See Options

03

Implement

Free Strategy Session

Although benefits are often a top 3 expense on corporate P&Ls, many companies struggle to quantify how their benefits investment supports their business objectives.

During this 60-minute strategy session, Health Compass CEO Donovan Pyle will assess your organization’s current state, challenges, and goals. After completing due diligence, you will collaborate to identify the key performance indicators (KPIs) needed to support your human capital strategy and broader business objectives.

Common KPIs for the first 12 months include:

Reducing health insurance costs by $1,000 per employee — without watering down coverage.

Increasing employee satisfaction scores by 20%.

Reducing employee turnover by 10%.

Solutions Group

Solutions Group

Health Insurance Strategy Audit (HISA)

Inquire for Pricing

The Problem

Although 81% of employers use benefits brokers for guidance on how healthcare should be financed and procured for employees, healthcare has become a top expense for most organizations, and 25% of what the average employer spends is considered waste.

A root cause of this waste is that benefits brokers get paid commissions and bonuses from health insurers and vendors, meaning brokers make more money when an employer’s healthcare costs go up – not down. Therefore, benefits brokers have little incentive to maximize an employer’s healthcare investment.

The Solution

Fortunately for employers, Health Compass Consulting’s revolutionary fee-based benefits consulting model allows us to give employers objective advice on how healthcare dollars should be invested — without financial conflicts of interest.

The Health Insurance Strategy Audit (HISA) from Health Compass analyzes your broker’s recommendations over the past four years so that Executives can determine if their broker’s advice was practical and prudent. Furthermore, the audit empowers Executives with the high-level strategic insights necessary for better purchasing decisions in the future.

After the audit is complete, Executives and Managers meet with Health Compass CEO Donovan Pyle for 60 minutes to review audit results and ask any questions they may have.

Strategic Health Insurance

Creation (SHIC)

Inquire for Pricing

The Problem

25% of what employers spend on healthcare is wasted because benefits brokers work for insurance companies — not employers. As a result, they make more money when your costs go up — not down.

The Solution

Health Compass Consulting is the first fee-based employee benefits consulting firm in the United States — which means we work for you — not insurance companies. This financial alignment allows us to give employers objective advice on how healthcare dollars should be invested — without financial conflicts of interest.

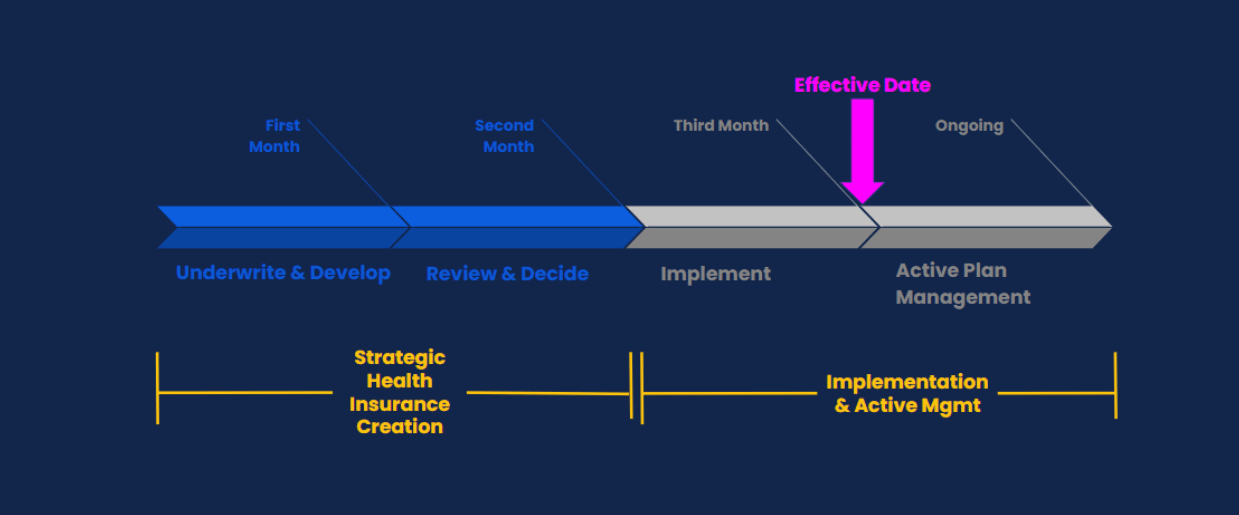

The Strategic Health Insurance Creation (SHIC) project from Health Compass produces the multi-year strategy, insurance products, and pricing needed to achieve key performance indicators (KPI) identified in your free strategy session.

Clients who elect to have Health Compass implement and manage any of the options Health Compass produces have 100% of the deposit credited toward the first year's benefits management fee.

If you're not 100% satisfied, we'll refund your deposit...no questions asked.

Solutions Group

Solutions Group

Benefits Management

Inquire for Pricing

Since most organizations don’t have certified in-house resources needed to manage high-performing benefits programs, Health Compass provides clients with all the resources necessary to make their benefits transformation a reality.

The turn-key benefits management bundle provided by Health Compass reduces administrative work for HR professionals while maximizing your company's benefits investment and improving employee satisfaction.

Since most organizations don’t have licensed, in-house, resources needed to manage high-performance health plans, Health Compass provides clients with all the resources needed to make their transformation become a reality.

Here are the services typically included in our turn-key management bundle:

Strategy & Procurement Services

- Create a multi-year benefits strategy

- Advise on benefits design and develop cost modeling

- Negotiate pricing with solution providers

- Develop custom health plans

- Negotiate vendor renewals

- Identify and vet new solution providers and changes in the product landscape

Executive Education Services

- Tailored executive workshops

- Speaking engagements

- Macro strategy conversations

Engagement Services

- Educate employees through virtual and in-person group meetings as well as individual enrollment meetings

- Develop marketing campaigns that educate and engage employees

- Create total compensation reports

Technology Services

- Provide and/or advise on benefits administration technology

- Build and manage benefits administration systems

- Manage integrations with third-party vendors

Benefits Management Services

- Manage vendor performance

- Advocate for and help employees resolve claim disputes

- Protect employees from predatory billing practices

- Send benefit changes to carriers and vendors

Compliance Services

- Advise on regulatory changes and risks

- Manage your program’s compliance calendar

- Audit your program for compliance risks

Here are some of the product solutions we procure, implement, manage, and advise on for our clients:

- Health Plans (fully-insured, level-funded, self-funded, unbundled self-funded)

- Dental, Vision, Disability, Life

- HSA, HRA, FSA

- Worksite Products (accident, critical illness, hospital indemnity, etc.)

- Pet Insurance

- Employee Assistance Programs

- Wellness and Financial Fitness Programs

“Although clients may be tempted to focus on products, we prioritize process and strategy at Health Compass.

We firmly believe that building a successful foundation requires a deliberate and clear blueprint, much like constructing a house. Neglecting this crucial step is sure to result in a poor outcome.”

Donovan Pyle - CEO, Health Compass

SHRM-SCP, REBC, CHVP

In our turn-key model, Health Compass provides you with the technology and resources necessary so that we can educate your population about how to use their benefits to achieve peak performance while improving user experience, health outcomes, and productivity.

After implementation is complete, we manage your vendor stack, help you comply with the ever-changing regulatory environment, and actively manage claims so that your plan and employees don’t get blind-folded and robbed by bad actors hidden in healthcare supply chains.

At renewal time, we negotiate with vendors on your behalf, and since we don’t accept bonuses or commissions from vendors (like traditional brokerage firms do), we’re able to “sit on the same side of the table” as our clients so that your benefits investment is maximized each year.

Throughout each plan year, our team continuously vets new vendors, refines old products, and develops new ones in order to meet the needs of our clients in this ever-changing marketplace.

Leadership Retainer

Inquire for Pricing

Leadership Retainer - (inquire for pricing) - Healthcare has never been more important to the way human capital, markets, and companies perform. As Executives face critical decisions about how to grow their business, allocate resources, and reduce operating expenses, healthcare is a wildcard that can make or break almost any company’s success.

These decisions require deep expertise that in-house teams cannot build fast enough and, therefore, benefit from an independent perspective that can pinpoint overlooked risks and opportunities.

What separates our consulting practice is the “front of the line” access clients have to our CEO — Donovan Pyle — a leading voice in healthcare procurement, financing, and risk management.

We offer impactful consulting with in-person meetings, custom briefings, one-on-one video conferencing, and individual phone and email communications

We also offer:

Tailored Executive Workshops

Speaking Engagements

Macro Strategy Conversations

Our independent and deep industry knowledge gives executives and their board members the clarity, confidence, and control needed to make effective healthcare and human capital investment decisions.

01

Set Goals

02

See Options

03

Implement

Performance Based Consulting

No Fees - Percentage of Savings

Health Compass improves the financial and physical health of successful businesses by cutting bad actors out of healthcare supply-chains so they can attract and retain the talent needed to achieve their goals.

For self-insured groups, our “bolt-on” solutions improve benefits, achieve savings within the first 30 days, and can be implemented at any time — without fees or replacing vendors.

Executive Benefits

Retaining key employees is often critical for achieving business objectives, but understanding what strategies and solutions effectively retain executives can be challenging.

Health Compass’s Executive Benefits practice leverages decades of experience to develop customized strategies for retirement planning, individual insurance solutions, and investment vehicles that help you achieve your goals.

Our customizable vehicles for success include:

- Private annuities

- Split-dollar plans

- Buy sell agreements

- Corporate-owned life insurance

- Estate and tax planning

- ESOP buyouts

- Section 162 executive bonus plans

Integrity | Transparency | Accountability

Julie Garofalo,

HR Manager At Champion Solutions Group

With Health Compass, we were able to revamp our health insurance strategy — IMPROVE the availability of our best plans to remote employees, improve benefits communication through out the organization, and save on premium costs.

Dr. Edie K. Benner PT, PhD, OCS,

President at Advanced Rehabilitation & Health Specialists

Health Compass not only showed us how to reduce costs without compromising coverage, but they also connected us with employers who were looking to work directly with independent healthcare providers like us.

Ken Peach

Executive Director, Health Council of East Central Florida

Health Compass has charted its own path to save employers over $1,000 per employee while also eliminating copays and deductibles that often prevent employees from getting the care they need.

Why Health Compass?

There are many smart people who could potentially help you achieve your goals. So why work with Health Compass? Here are several reasons we trust you will find compelling:

Why Health Compass?

There are many smart people who could potentially help you achieve your goals. So why work with Health Compass? Here are several reasons we trust you will find compelling:

1) Our CEO, Donovan Pyle, is only 1 of 22 health insurance consultants in the U.S. certified by the Validation Institute — an organization born out of the World Congress that independently validates the performance claims of solutions providers.

2) Our clients range in size from 10 employees to over 10,000 employees.

3) Our CEO, Donovan Pyle, is only 1 of approximately 300 health insurance consultants in the U.S. that have achieved the highest designation awarded by the National Association of Health Underwriters (NAHU).

4) Our thought leadership and white papers are published in national publications like Yahoo Finance, Go-Banking Rates, the Society for Human Resources Management (SHRM), Advisor Magazine, and I’m a member of the Orlando Business Journal’s Leadership Trust.

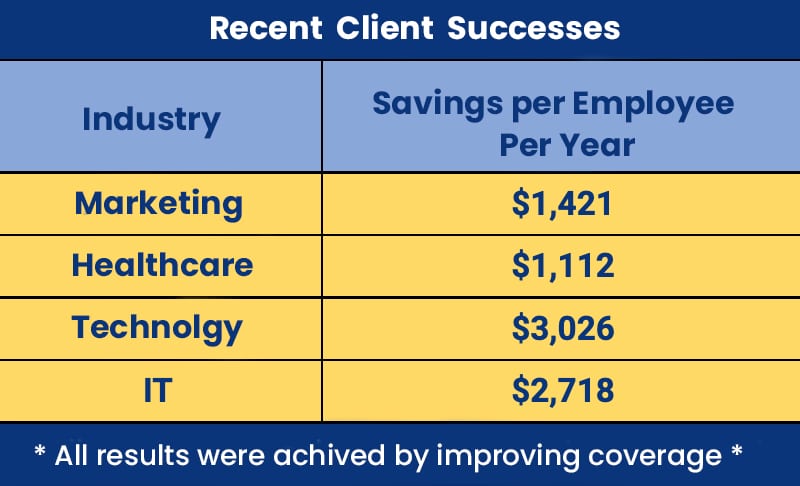

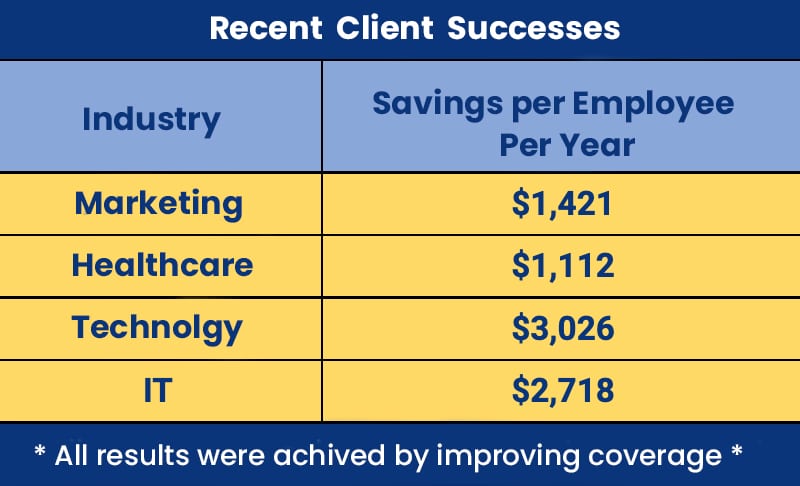

5) We developed a new business model for the benefits brokerage industry that aligns incentives between brokers and employers and founded Health Compass in 2018 — arguably the first radically transparent consulting and brokerage firm that guarantees by results by taking on financial risk. Our average client savings in 2021 were $1,850 dollars per employee, per year.

6) We have over 10 years of experience representing Unions in Florida, New Jersey, and Nevada.